Zustellung: Mo, 21.07. - Mi, 23.07.

Versand in 2 Tagen

VersandkostenfreiBestellen & in Filiale abholen:

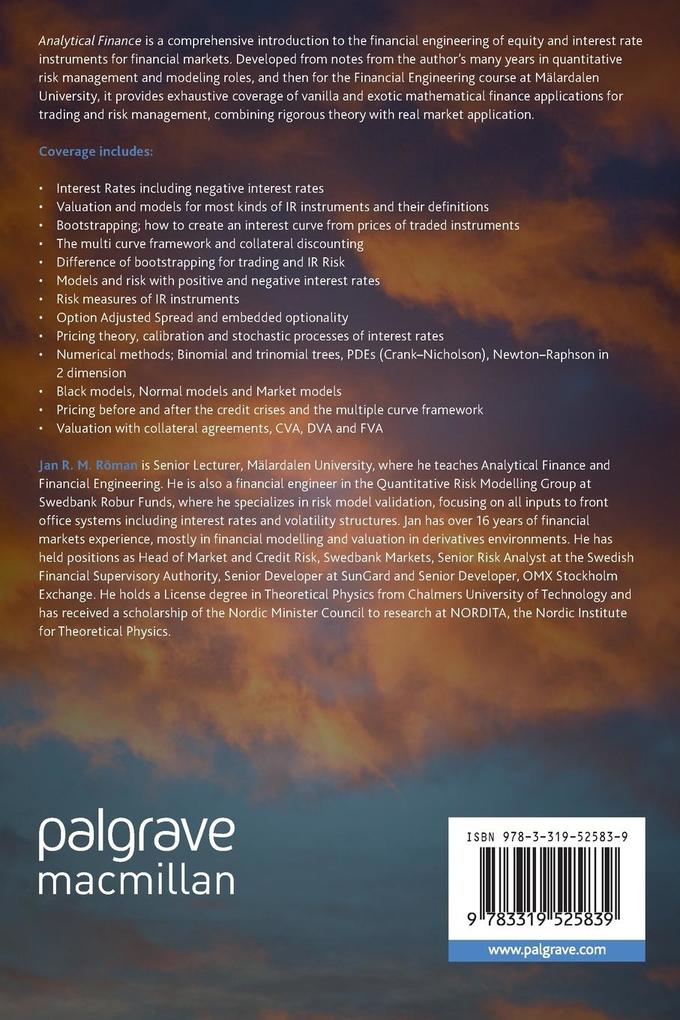

Analytical Finance is a comprehensive introduction to the financial engineering of equity and interest rate instruments for financial markets. Developed from notes from the author's many years in quantitative risk management and modeling roles, and then for the Financial Engineering course at Mälardalen University, it provides exhaustive coverage of vanilla and exotic mathematical finance applications for trading and risk management, combining rigorous theory with real market application.

Coverage includes:

Inhaltsverzeichnis

Pricing via Arbitrage. - The Central Limit Theorem. - The Binomial model. - More on Binomial models. - Finite difference methods. - Value-at-Risk VaR. - Introduction to probability theory. - Stochastic integration. - Partial parabolic differential equations and Feynman-Ka . - The Black-Scholes-Merton model. - American versus European options. - Analytical pricing formulas for American options. - Poisson processes and jump diffusion. - Diffusion models in general. - Hedging. - Exotic Options. - Volatility. - Something about weather derivatives. - A Practical guide to pricing. - Pricing using deflators. - Securities with dividends. - Some Fixed-Income securities and Black-Scholes.

Produktdetails

Erscheinungsdatum

13. Dezember 2017

Sprache

englisch

Auflage

1st edition 2017

Seitenanzahl

760

Reihe

Analytical Finance, 2

Autor/Autorin

Jan R. M. Röman

Verlag/Hersteller

Produktart

kartoniert

Abbildungen

XXXI, 728 p. 141 illus.

Gewicht

1130 g

Größe (L/B/H)

235/155/41 mm

ISBN

9783319525839

Entdecken Sie mehr

Bewertungen

0 Bewertungen

Es wurden noch keine Bewertungen abgegeben. Schreiben Sie die erste Bewertung zu "Analytical Finance: Volume II" und helfen Sie damit anderen bei der Kaufentscheidung.