Zustellung: Di, 17.06. - Do, 19.06.

Versand in 4 Tagen

VersandkostenfreiBestellen & in Filiale abholen:

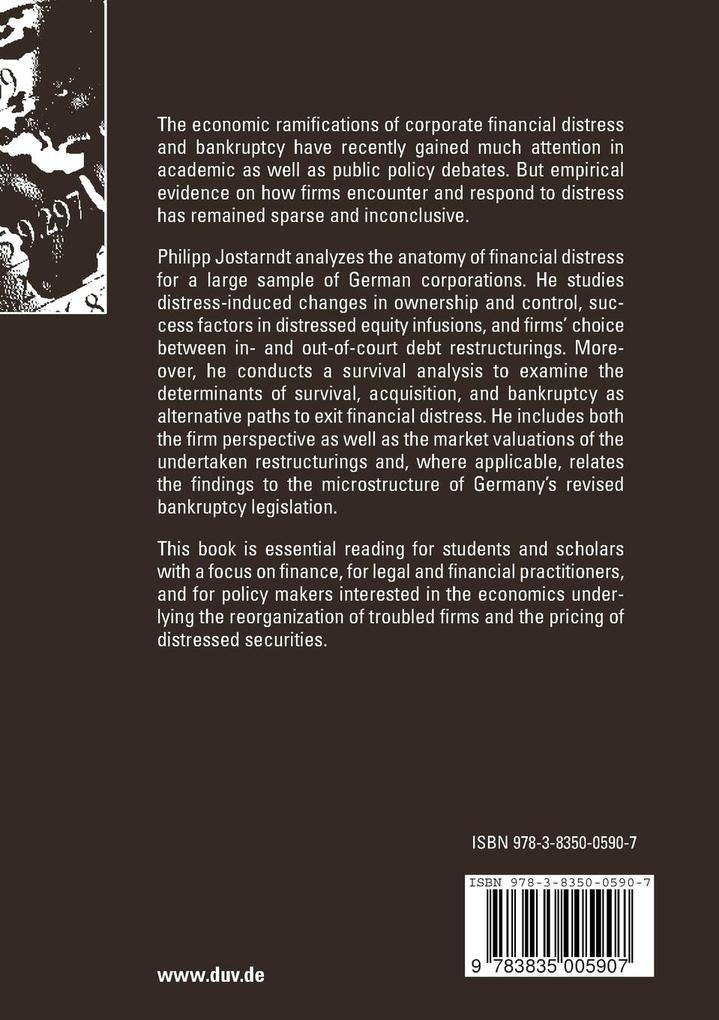

Research on corporate distress and bankruptcy and the accompanying e? orts of ? rms to restructure their operations and balance sheets have become an increasingly important ? eld in ? nancial economics and business administration. Especially in Germany where the recent period of economic downturn and large-scale bankruptcy ? lings coincided with extensivereformsofthebankruptcylegislationthetopichasenjoyedcontroversialdebates among economists, legal scholars and public policy makers. Yet so far insights from empirical research that can provide valuable guidance in these debateshaveremainedsparseandinconclusive. Onereasonforthelackofevidenceisthat common ? nancial theory on corporate restructuring is not fully compatible with the G- man institutional background and thus often allows only ambiguous predictions. Mo- over, empiricalinvestigationsofGermanrestructuringshavesofarbeenalmostimpossible due to the lack of exhaustive data. This holds in particular for private reorganizations, which present the predominant form of restructuring distressed ? rms in Germany. Many economically highly interesting aspects pertain to this ? nal stage in the corporate li- cycle. Forexample, thequestionwhetherthe? rm'smanagement, shareholdersorcreditors should trigger a formal bankruptcy proceeding or, alternatively, pursue a going-concern in an out-of-court workout has a myriad of economic implications.

Inhaltsverzeichnis

Data selection and sample descriptives. - Financial distress, corporate control, and management turnover: A German panel analysis. - Of bail-outs and bankruptcies: An empirical study of distressed debt restructurings in Germany. - Claimholder conflicts in distressed equity offerings: Evidence from German restructurings. - A study of firm exit and survival in financial distress.

Produktdetails

Erscheinungsdatum

22. Februar 2007

Sprache

englisch

Auflage

2007

Seitenanzahl

220

Autor/Autorin

Philipp Jostarndt

Vorwort

Prof. Dr. Bernd Rudolph

Verlag/Hersteller

Produktart

kartoniert

Abbildungen

XVII, 201 p.

Gewicht

326 g

Größe (L/B/H)

210/148/14 mm

ISBN

9783835005907

Entdecken Sie mehr

Bewertungen

0 Bewertungen

Es wurden noch keine Bewertungen abgegeben. Schreiben Sie die erste Bewertung zu "Financial Distress, Corporate Restructuring and Firm Survival" und helfen Sie damit anderen bei der Kaufentscheidung.